will capital gains tax rate increase in 2021

The Wall Street Journal reports. By Curious and Calculated April 29 2021 2 Comments.

Once fully implemented this would mean an effective federal.

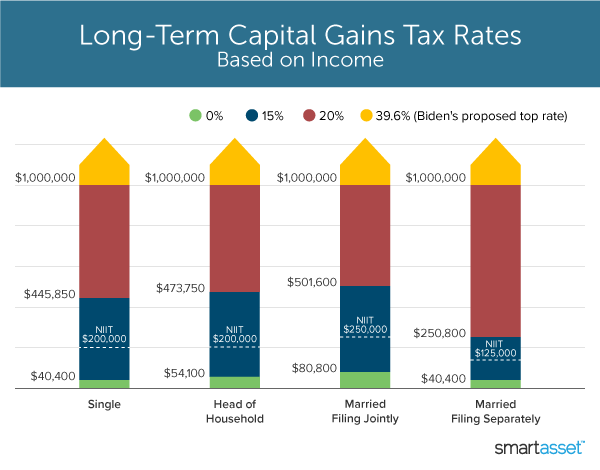

. On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains tax rate for households with income exceeding 1 million to 396 from the current 20 tax rate. Posted on January 7 2021 by Michael Smart. The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. By Freddy H. Its time to increase taxes on capital gains.

By Ken Berry JD. Your 2021 Tax Bracket to See Whats Been Adjusted. Ad Compare Your 2022 Tax Bracket vs.

Profits from the sale of an investment such as shares of a stock or real estate are subject to capital gains taxes. The proposal would increase the maximum stated capital gain rate from 20 to 25. President Bidens team released details related to.

On December 31 2026 the taxpayer will receive a 100000 10 step-up in basis so the 28 capital gains tax rate will be applied to. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. How much these gains are taxed depends on how long the asset was held before selling.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Single Filers Taxable Income Over. Capital gains tax could double in 2021 or 2022.

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2021. Short-term gains are taxed as ordinary income. The Chancellor will announce the next Budget on 3 March 2021.

Guide to What is Capital Gains Tax and its Definition. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Currently the top federal tax rate is 238 and could jump to 434 under the latest tax proposal.

Short-term capital gains are taxed like ordinary income at tax rates. On December 31 2026 the taxpayer will receive a 100000 10 step-up in basis so the 28 capital gains tax rate will be applied to 900000 of the deferred gain. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

Capital Gains Tax Rate Update for 2021. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. 2021-2022 Capital Gains Tax Rates Calculator Calculate Bill.

Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. Long-Term Capital Gains Tax Rates 2021. To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased.

President Bidens expected 6 trillion budget assumes that his proposed capital-gains tax rate increase took effect in late April meaning that it would already be too late for high-income investors to realize gains at the lower tax rates if Congress agrees according to two people familiar with the proposal. We explain long-term and short-term tax rates 2021 2022 rates and calculations. Capital gains tax rates on most assets held for a year or less correspond to.

The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million. It also includes income thresholds for Bidens top rate proposal and the 38 NIIT. In fact Bidens plan to raise the capital gains rate that wealthy Americans pay on profits from the sale of stocks or bonds from 238 to.

And here are the long-term capital gains tax rates for 2021. A capital gain occurs when the value of a capital asset increases and it is unrealized until the capital. The current tax preference for capital gains costs upwards of 15 billion annually.

NDPs proto-platform calls for levying. Discover Helpful Information and Resources on Taxes From AARP. Under Bidens proposal all taxpayers making more than 1 million in long-term capital gains would have to pay the 396 rate in addition to the 38 NIIT.

The effective date for this increase would be September 13 2021. Skip to primary navigation. Implications for business owners.

Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic. Heads of Households Taxable Income Over. While it is unknown what the final legislation may contain the elimination of a rate increase on capital gains in the draft legislation is encouraging.

Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. At the end of this post I share a free calculator that will show you the cost difference.

Apr 23 2021 305 AM. The announcement of the plan formally kicked off the legislative. Married Couples Filing Joint Returns Taxable Income Over.

In simple words it is the tax applied on realized capital gains. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

Remember if you have short-term capital gains they are taxed at the ordinary income tax rates. Assume the Federal capital gains tax rate in 2026 becomes 28. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

For example if Julia bought shares in Apple in February and sold them in November of the same year her gain or loss on the investment will be classified as short-termLong-term capital gains assets held for more than one year are taxed at 0 for taxpayers in the 10 and 15 tax brackets and 15 for. The proposed capital gains tax reforms of which any Budget. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund.

Here are the 2021 long-term capital gains tax rates.

Capital Gains Tax What Is It When Do You Pay It

What S In Biden S Capital Gains Tax Plan Smartasset

Tax Calculator Estimate Your Income Tax For 2022 Free

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Double Taxation Definition Taxedu Tax Foundation

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What S In Biden S Capital Gains Tax Plan Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Selling Stock How Capital Gains Are Taxed The Motley Fool

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)